As you step into the realm of adulthood and begin your career journey, one important aspect of financial planning you’ll encounter is Social Security. You may have seen deductions on your first paycheck marked as ‘Social Security taxes’ and wondered what they really entail. Here’s a simple guide to help you understand how this fundamental program works and how it benefits you and millions of others.

What is Social Security?

Social Security is a federal program in the United States designed to support retired individuals, disabled people, and families of retired, disabled, or deceased workers. Funded through payroll taxes, this program ensures that you have financial assistance during your retirement years or in case of disability, and it supports your family in the event of your death.

How Social Security is Funded

Social Security is primarily funded through payroll taxes under the Federal Insurance Contributions Act (FICA). As an employee, you contribute 6.2% of your earnings up to a certain wage limit, and your employer matches this contribution by also paying 6.2%. This collective pool of funds finances the Social Security benefits distributed to eligible individuals and families.

Earning Your Credits

Throughout your working life, you earn “credits” toward Social Security benefits. You can earn up to four credits per year, and generally, you need at least 40 credits (equivalent to 10 years of work) to qualify for retirement benefits. Depending on your circumstances, fewer credits might be needed to qualify for disability or survivor benefits.

How The Benefits are Calculated

The amount of Social Security benefits you receive upon retirement or disability is calculated based on your earnings history. The formula used considers your highest years of earnings, adjusting for inflation. Essentially, the longer you work and the more you earn, the higher your benefits will be, subject to maximum limits.

Receiving Benefits

You can start receiving Social Security retirement benefits as early as age 62, although full retirement age is currently between 66 and 67, depending on your birth year. Benefits can also be deferred until age 70 to increase the monthly disbursement. In the case of disability, benefits are based on your work credits and specific eligibility criteria. If you die, your dependents, such as a spouse or minor children, may receive survivor benefits based on your earnings record.

Annual Adjustments

Social Security benefits are adjusted for inflation each year through Cost-of-Living Adjustments (COLAs), ensuring the buying power of Social Security does not decrease over time. This adjustment is crucial for maintaining the standard of living for beneficiaries.

Social Security and Financial Advisors

When it comes to optimizing your Social Security benefits, a financial advisor at https://retiretrunorth.com/ can play a pivotal role. These professionals provide crucial guidance tailored to your specific financial situation and future goals. Here’s how they can help:

Strategic Planning for Benefits: Financial advisors can help you determine the optimal time to start claiming Social Security benefits based on your financial needs, health status, and life expectancy. This decision can significantly impact the total benefits you receive over your lifetime.

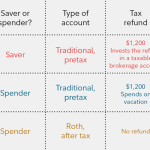

Integrating with Other Retirement Plans: A financial advisor can show you how to integrate your Social Security benefits with other retirement savings accounts like 401(k)s, IRAs, and pensions. This integration ensures that you have a balanced approach to your retirement income.

Tax Implications: Your Social Security benefits may be taxable depending on your overall income in retirement. Financial advisors can provide strategies to minimize taxes and maximize your income streams.

Long-term Financial Projections: Advisors use various tools to project your financial situation years into retirement. This can help you understand how much you can rely on Social Security versus how much you should be saving in other retirement accounts.

Addressing Unexpected Scenarios: Life can be unpredictable. A financial advisor can help prepare for unforeseen circumstances like disability or early retirement, ensuring that you maximize your benefits under these conditions.

Why It Matters

Understanding Social Security is vital because it’s likely to form a foundational part of your retirement planning. While it’s not advisable to rely solely on Social Security for retirement income, the benefits provide a significant safety net that can help you manage your financial future more effectively.

Conclusion

As you embark on your career, keep in mind the importance of planning for retirement early. Social Security is an essential element of the broader strategy, which should also include other retirement savings plans like 401(k)s and IRAs.

Being aware of how Social Security works not only prepares you for future financial stability but also informs you about the benefits you are entitled to in various life situations. Start planning today to secure a more comfortable and assured tomorrow.