When planning for retirement, choosing the right savings account is crucial. Among the most popular options are Roth IRAs and 401(k)s, each offering unique tax benefits that can significantly impact your financial future. Understanding how taxes work with these accounts will help you make an informed decision based on your personal financial situation and retirement goals.

What is a Roth IRA?

Choosing the right retirement advisor like https://retiretrunorth.com/clemson-sc/ can help you understand which retirement account is best for you. A Roth IRA is an individual retirement account that allows you to contribute after-tax dollars. This means you pay taxes on your contributions upfront, but your money grows tax-free, and you can make tax-free withdrawals in retirement, provided certain conditions are met.

What is a 401(k)?

A 401(k) is a retirement savings plan sponsored by an employer. It allows employees to save and invest a portion of their paycheck before taxes are taken out. Taxes are not paid on the money until it is withdrawn from the account, typically during retirement.

Key Tax Differences

1. Taxation on Contributions

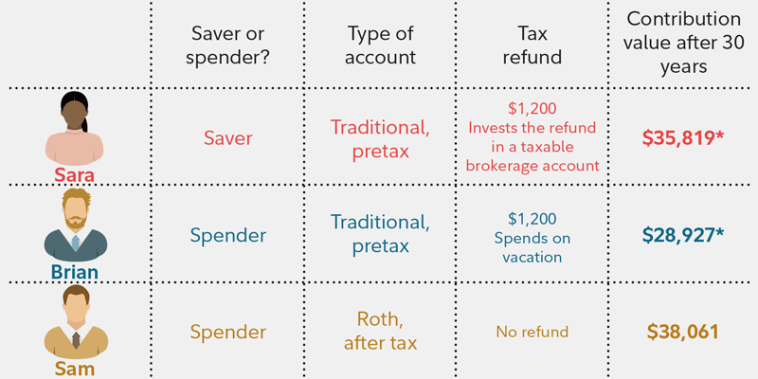

- Roth IRA: Contributions are made with after-tax dollars. You do not get a tax deduction in the year you make the contribution.

- 401(k): Contributions are made with pre-tax dollars. This reduces your taxable income for the year you contribute, providing an immediate tax break.

2. Taxation on Withdrawals

- Roth IRA: Withdrawals are tax-free in retirement as long as you are at least 59½ years old and have held the account for at least five years.

- 401(k): Withdrawals are taxed as ordinary income during retirement. Since the contributions were pre-tax, every dollar withdrawn is subject to income taxes.

3. Required Minimum Distributions (RMDs)

- Roth IRA: There are no RMDs during the owner’s lifetime, meaning you are not required to withdraw money at any specific age.

- 401(k): RMDs must begin at age 72, requiring you to start withdrawing funds and paying taxes on them.

Choosing Between a Roth IRA and a 401(k)

The choice between a Roth IRA and a 401(k) often comes down to your current tax rate versus your expected tax rate in retirement:

- If you expect your tax rate to be higher in retirement, a Roth IRA may be more beneficial, as you lock in your current lower tax rate on contributions, and withdrawals are tax-free.

- If you expect your tax rate to be lower in retirement, a 401(k) might be the better choice, as you defer taxes while in a higher tax bracket and pay taxes at a lower rate in retirement.

Combining Both

Many financial advisors recommend diversifying your tax exposure by using a Roth IRA and a 401(k). This can help you manage your taxes better in retirement, depending on your spending needs and the prevailing tax laws.

Conclusion

Both Roth IRAs and 401(k)s are powerful tools for retirement savings, but they serve different tax purposes. By understanding the distinctions and how they align with your financial strategy, you can better prepare for a comfortable and financially secure retirement. Remember, when in doubt, consulting with a financial advisor can provide personalized advice tailored to your specific situation.